For many companies, the COVID-19 pandemic has generated unpredictable volatility. Some have seen significant drops in demand creating added pressure on their fixed costs, while others benefiting from the transition to remote work have yet to align cost structures with the new norm of their business.

In both cases, optimizing Service Costs and Operations are the current topics keeping decision makers up at night.

Cost to serve: while the concept is broadly understood, its sub-components and levers of optimization are often elusive.

Working with our clients to optimize their bottom line, we come across various visions on what is the Cost of Goods Sold (COGS), Cost of Service or Total Cost of Ownership and what each of these definitions is comprised of.

Some of these differences are obviously explained by the diversity of businesses. After all, a B2B local manufacturing operation features very different metrics than a B2C global SaaS business or a hotel chain group. However, regardless of the nature of the underlying business, across our engagements we often encounter very different ways of accounting for costs or recognizing revenues, thus (mis)leading to ill-informed managerial decisions.

Through interviews with client stakeholders, we’ve discovered that project finance and accounting practices are often defined by personal interpretations to what falls into the different categories of costs rather than the result of a robust process of fixed costs and overhead allocations.

These practices deprive company executives from the appropriate granularity of the profitability picture and can lead to poor strategic decisions rather than enabling optimizations.

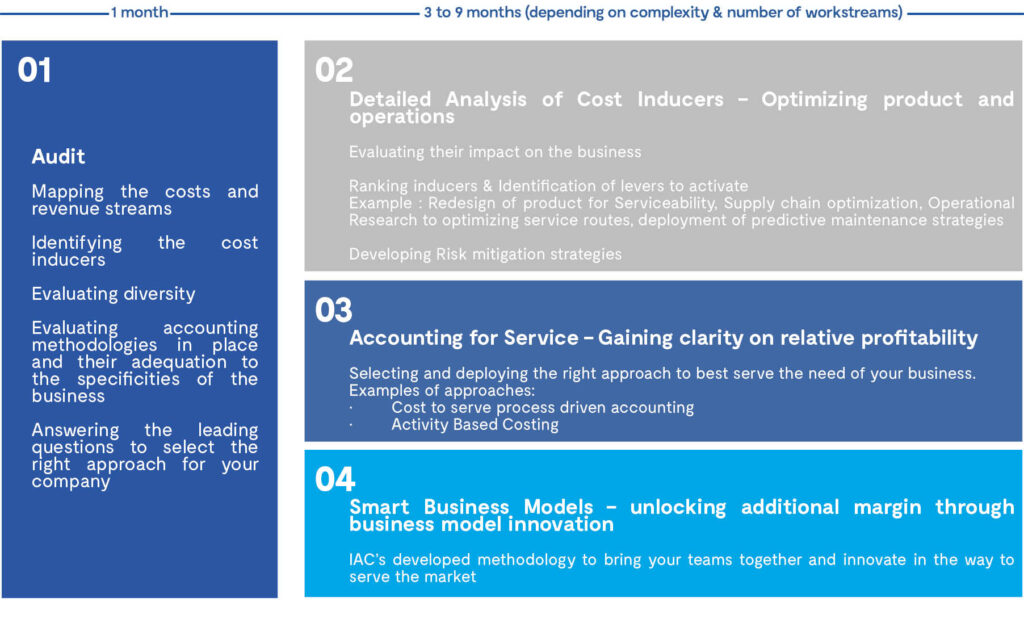

Audit Phase

In order to adapt to the specificity of our client’s business, each engagement to optimize Cost of Service – and ultimately overall Service Operations – starts with an audit to gain clarity on the variables at play. At this stage, we don’t hold ourselves to a restrictive definition of Service Cost or COGS to avoid any analysis bias.

Due to service being both a cost center and a revenue driver, we look at every business with a holistic approach, carefully monitoring the interaction between the top line and the bottom line in order to boost profits through optimization of Cost to Serve and Service Operations. It’s critical to avoid wrongly incentivized “cost killers” that achieve significant savings at the expense of the revenue pipeline. The best cost possible isn’t good to any business if it sacrifices revenue in the process. At IAC Partners, any recommendation we push is under the angle of profit and Net Present Value for our clients to find the sweet spot where profit is maximized.

The framework of our discovery audit will allow us to:

- Map the costs and revenue streams

- Identify their inducers so they can be optimized for revenue and impact mitigated for costs.

- Understand the diversity facing the business (product mix, customer segmentation, distribution and service channels, pricing, geographies, etc…)

- Evaluate accounting methodologies in place and their fit to proper cost tracking

- Compare the service model of the company to similar companies and evaluate the room for disruptive approaches to unlock higher EBITDA

Analysis Phase

Based on the result of our audit we will select a tailored approach, activating the relevant levers for both quick and long-term gains. Our approach will typically revolve around 1 to 3 work streams in sequence or parallel:

- Optimizing the cost and revenue inducers with the selected strategy

- Examples of levers: Re-design of product for serviceability, Segmentation of customer base to pursue better alignment of sales force, Operational research to optimize service routes, Predictive maintenance to optimize field service operations, Optimization of service contracts (both pre-sale with distribution channels and post-sale with clients)

- Accounting for Service – gaining clarity on relative profitability

- We will ensure that the grey area of overheads flows properly at the right level of the diversity inducing these overheads.

- Typically, low volume/high complexity products tend to underpay their fair share of overheads, which has a negative impact on other products. The same applies with distribution channels and client diversity.

- Smart Business Model Approach

- Unlocking additional profitability by doing things differently

- Our customized methodology will bring your teams together in engaging workshops exploring ways to service your market differently, which can ultimately lead to an additional way to change the cost inducers.

Implementation

We like to see things through. To us, aligning incentives is essential for a fruitful collaboration.

Depending on our clients’ needs and flexibility, we cater our approach to either full implementation or performing the PMO/change management role to ensure that the transformation path laid out is walked seamlessly, ensuring full realization of the identified value for our clients. It’s not about identifying why optimization is necessary and what needs to be transformed with whom, but also about how to do it in an agile environment where strategy adjustments along the way may arise

Tangible results at each mission

July 17, 2023

The space industry’s path to a sustainable future

July 4, 2023

Measure R&D performance

June 19, 2023

Standardization perspectives of nuclear plants

June 8, 2023