Our success keys to conquer an emerging country

Emerging country: a country that stands out among other developing countries due to strong macroeconomic results (industrial production, employment) and a high economic growth rate. (Larousse French Encyclopaedia)

Today, the dilemma that industrial companies are facing is no longer whether or not to expand commercially into emerging markets, but rather how to develop an effective action plan to maximize chances of success.

The fact is that the dynamics at play in emerging markets are very different from those of more mature economies: client profiles, industrial ecosystems, demand variability, labour market, workforce education, etc.

The opportunities they present are immense; the perspective of new business (vs renewals), pioneer advantage, and strong economic and demographic growth rates are pushing industrial companies of all sectors to take an interest.

But the challenge is just as immense as the reward.

First, let us have a look at a strategy that does not work: duplicating an offering that was successful in Europe without adapting it to the specificities of the target market. This is not just about pricing.

The entire range of the offering may need to be re-examined: products, services, value chain.

So how can you break into an emerging market with minimal risks and costs? How do you develop a fresh and tailored strategy without losing touch with your history, your experiences and those trusted, time-tried solutions?

The expertise that IAC has developed while collaborating with industrial companies that have managed to gain a foothold on emerging markets has brought to light three conditions for success.

- The first condition is to have precise insight into your prospective customers’ product needs and value chain.

- Equally important is the technical agility to adapt rapidly to diverse and fluctuating demand.

- The third key to success is having an effective rollout plan that addresses issues related to supply chain strategy and time-to-market optimization.

As explained above, companies wishing to penetrate emerging markets will need to do more than simply transpose their offering and the marketing strategy they are successfully conducting in developed countries into these new territories.

Emerging markets are a diverse reality; each country has its own unique set of circumstances and specific needs.

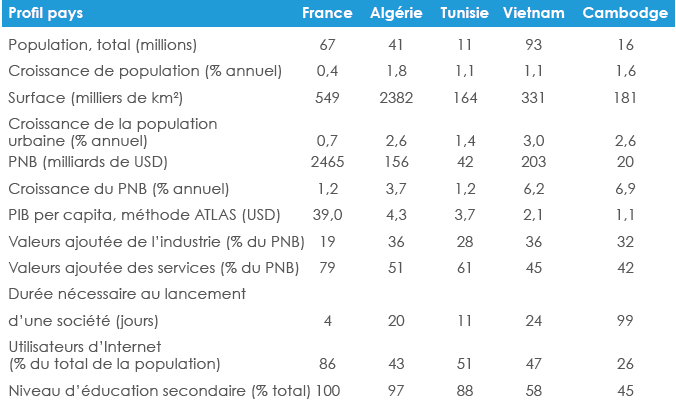

To develop a tailored strategy, industrial companies first need to get acquainted with some general data, even before they delve into the thick of things and start poring through market analyses.

A macroeconomic approach yields a comprehensive overview of the market: level of advancement and education, volume of prospective business, demographic segmentation.

In this instance, we learn that despite the fact that some figures — annual urban population growth, proportion of industrial production in the GNP — are similar for North African and South- Eastern Asian countries, there still remain some dramatic differences:

•the GDP per capita is twice higher in North Africa than that of South-Eastern Asia;

•access to secondary education in North Africa is similar to that of France, much higher than in Vietnam and Cambodia;

•the economic growth rate is twice higher in Vietnam and Cambodia.

Depending on the sector, it might be pertinent to consider other indicators: mean age, life expectancy, annual cement production for the vitality of the construction industry, etc.

Another fundamental parameter to explore is regulatory environments, in order to anticipate hidden costs (border taxes, local standards) that could impact your penetration strategy But only a market analysis, with a very practical field approach, can help industrial companies clearly identify the needs of their prospective customers.

Let us illustrate this with the case of one of IAC’s clients: a manufacturer of turnkey solutions for brick-making equipment had reached its maximum potential on Western markets, so they started considering turning to high-growth markets. An in-depth market analysis of the brick industry in Iran and North African countries was conducted through face-to-face interviews with local business owners. It found that:

- local quality standards were not the same as in Western countries;

- the extent of automation expected by local prospective customers was much lower than what European manufacturers were accustomed to;

- product ranges were usually much less diversified (one or two products, as opposed to over 30 on more mature markets) ;

- structural works were performed by local artisans.

•a particular feature can be altered to meet local expectations. For instance, LG developed higher-quality sound systems for their televisions when they became aware that Indian consumers often used theirs to listen to music;

A competitor analysis — provided there are competitors already established on the market — is another crucial element to help determine goals in terms of pricing and product performance. In this particular instance, the competition consisted of Southern European and local companies, usually family-owned or small-scale operations. Lastly, once the customer’s product expectations have been determined and prioritized, a value analysis approach provides the means to adjust the product’s specifications and design to match actual needs:

•new features can be added to an existing product to differentiate it from competing offerings. For instance, Samsung launched on the Indian market a washing machine with a ‘sari’ cycle, specifically developed to prevent the clothes from getting tangled;

•some features can be removed in order to match actual needs and take into account the variability of resources available. For instance: automation on brick-making equipment.So does a distinct offering always translate to a distinct technical solution? Not necessarily. In some cases, a modular range approach can be an appropriate strategy to minimize costs and risks associated with expanding into new markets.

Use modular design to cover the performance of a whole range.

In the case of this company, what they wanted was ideally to develop a basic low-cost and little- automated solution, delivered unassembled, with no turnkey installation services associated, specifically targeted to Iran and Algeria.

However, this solution also had to accommodate the possibility to meet renewal demand on more mature markets by delivering machines with greater automation, better control of baking temperatures and turnkey installation services.

And of course without spending twice the amount in development costs.

Modular design is a cost-effective solution to develop a diverse product range. The concept is quite simply to design a module — i.e. functional unit — for each operation, which can be combined to develop an offering just as diverse as a regular range.

That is how IAC helped its client develop a modular brick-manufacturing line consisting of:

•a basic baking unit…

•…with the possibility to attach several units together to increase baking time, depending on outside temperature,

The same principle was applied to each single technical unit of the production line, regardless of its intended market:

- Iranian market: outside temperature around 22°C, low-skilled workers and cheap labour;

- German market: outside temperature around 15°C, rare and highly-skilled workers.

However, transitioning to a modular range alone is not usually enough to deliver a competitive offering. Additional steps must be taken in order to reduce the cost of each individual module. At this stage, a design-to-cost approach can yield significant cost savings — reduced by 20- 25% compared to a non-optimized equivalent.

This approach focuses on four parameters in addition to those addressed above:

- technical solutions: reducing complexity, choosing the right materials, the right technologies;

- procurement, depending on activities: Global or local suppliers?

- Co-designed or standard components?

- Manufacturing process: these choices will impact labour costs down the line and companies need to assess their supply chain and decide whether to make or buy ahead of time, all the while keeping the local context in mind.

Once the offering and the product have been defined, all that is left is implementing the proposed action plan and successfully rolling out.

Tangible results at each mission

July 17, 2023

The space industry’s path to a sustainable future

July 4, 2023

Measure R&D performance

June 19, 2023

Standardization perspectives of nuclear plants

June 8, 2023